Oil Prices Increase - Inflation

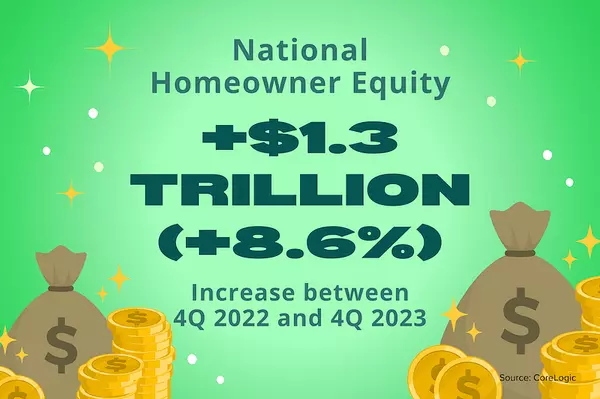

Higher oil prices raised headline CPI, while core CPI eased. The Fed focuses more on core for interest rates. Despite 30-yr mortgage rates over 7%, home prices still rise monthly. Inflation Oil prices recently surged, pushing the headline Consumer Price Index (CPI) up from 3.3% YoY in Ju

Recent Posts

A Surprising February in Real Estate & What Lies Ahead

March Market Musings: Navigating the Winds of Change

What's Up Real Estate - February

What's Up Real Estate - January

What's Up Real Estate - Fall Back

Happy Halloween - 2023

What's Up Real Estate - October

What's Up Real Estate - Jobs Reports

What's Up Real Estate - Half Way Through

What's Up Real Estate - September