March Market Musings: Navigating the Winds of Change

🌼 March Market Musings: Navigating the Winds of Change 🌼

Dear Valued Readers,

I hope this message finds you well as we eagerly step into the brighter, promising days of spring. The recent weeks have been a mixed bag of surprises, revisions, and cautious optimism in both the labor market and the real estate sector. Let's dive into what this means for us in the coming months.

📊 Labor Market Labyrinth

February's job report delivered a twist with 275,000 added jobs, surpassing the expected 200,000, suggesting continued economic resilience. However, January's "blowout" figure was significantly revised down from +353,000 to +229,000, casting a shadow of doubt on previous optimism. This revision, along with a slight uptick in unemployment to 3.9%, has the market in a contemplative stance. Are we witnessing a recalibration in job growth expectations? Bureau of Labor Statistics

🏡 Real Estate Refresh

On the real estate front, the landscape is brightening. New listings have surged by 15.8% YoY, with total active inventory up 21.7%—the most encouraging numbers since 2020. Yet, a word of caution: we're still navigating through inventory levels significantly lower than the pre-pandemic norm. Realtor.com

📈 Inflation Insights

Inflation remains a persistent theme, with February's CPI ticking slightly up to 3.2% YoY. The core CPI, a closer watchpoint for the Fed, edged down to 3.8% YoY, reflecting a slow but steady retreat from the peaks of inflation, especially in housing costs. Bureau of Labor Statistics

💡 Consumer Confidence and Spending

Retail sales rebounded with a 0.6% MoM increase in February, hinting at sustained consumer confidence and spending. This recovery is notably driven by a resurgence in auto sales, which might signal broader economic stability as we move deeper into 2024. U.S. Census Bureau

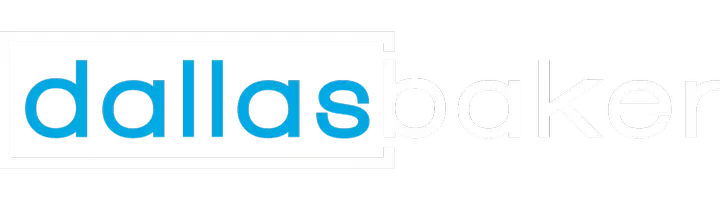

🏠 Housing Equity Highs

2023 was a landmark year for homeowners, with total home equity soaring by 8.6% to a staggering $1.3 trillion. The average equity per borrower now stands at an impressive $298,000, underlining the enduring value of home investment. CoreLogic

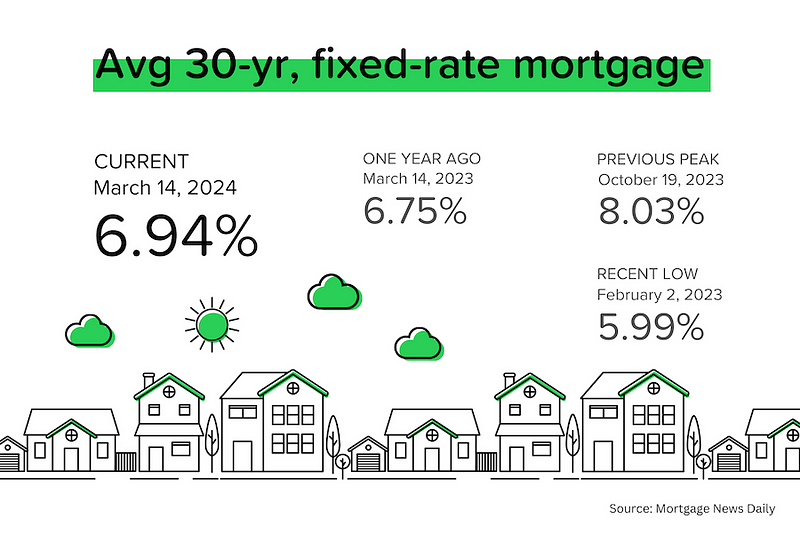

💰 Mortgage Market Mood Swings

The oscillations in the bond market, driven by the latest job figures and inflation data, have nudged mortgage rates back towards the 7% mark. As we anticipate the Fed's upcoming meeting and the reveal of the latest "dot plot" forecasts, the market braces for potential shifts in the Fed's rate strategy. Federal Reserve

Looking Ahead

With an eye on the Fed's next moves and the evolving dynamics of the housing market, we remain vigilant yet hopeful. While uncertainties linger, the foundational strength of the economy and a gradual stabilization in the real estate sector offer a silver lining.

As always, I'm here to guide you through these complex times with the insights and expertise you've come to trust. Let's navigate this journey together, embracing the opportunities that lie ahead in 2024.

Wishing you a prosperous spring and success in all your endeavors,

Recent Posts

GET MORE INFORMATION