A Surprising February in Real Estate & What Lies Ahead

Ready for the vibrant days of spring that are just around the corner? This week brought us some intriguing updates from the real estate market that I'm eager to share with you, along with insights into the broader economic landscape as we navigate through 2024. 🌟 February's Real Estate Highlights A

March Market Musings: Navigating the Winds of Change

🌼 March Market Musings: Navigating the Winds of Change 🌼 Dear Valued Readers, I hope this message finds you well as we eagerly step into the brighter, promising days of spring. The recent weeks have been a mixed bag of surprises, revisions, and cautious optimism in both the labor market and the re

What's Up Real Estate - February

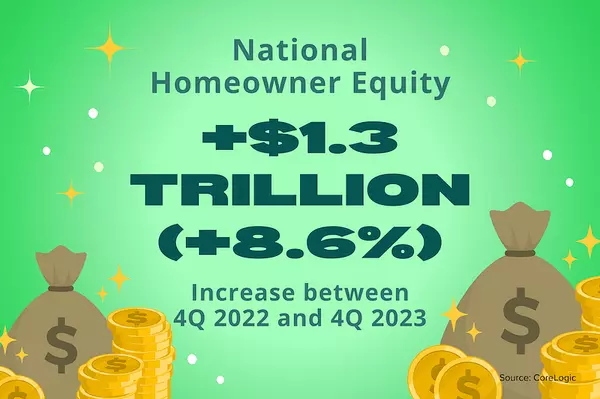

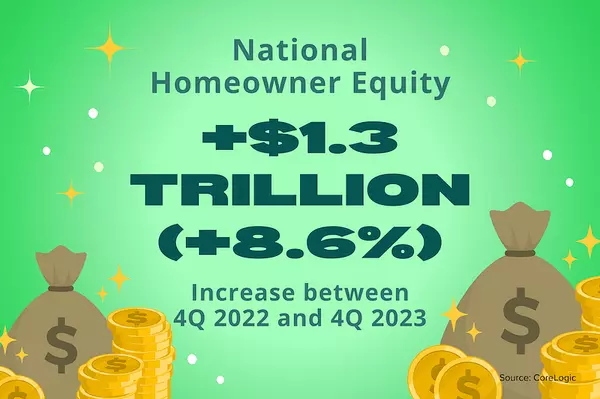

It's time to get back to business with an eye on the spring and summer selling seasons. Despite a dip in December's home sales and a challenging 2023, there are several reasons for both buyers and sellers to look forward to 2024 with optimism. 🏠 Real Estate Market: A Glimpse into 2024 Mortgage Rate

Recent Posts