What's Up Real Estate - Fall Back

Don't forget to enjoy that extra hour of sleep or fun as we fall back this November! 🍂⏰

As we adjust our clocks, the housing market seems to be adjusting as well—albeit at its own pace. Let's break it down:

The Case-Shiller Index marked its seventh consecutive month of growth, with national home prices rising 0.9% MoM in August 2023, gaining momentum from the 0.7% uptick in July. Year-to-date, prices have surged 4%, sitting comfortably at 1.5% above mid-2022’s peak. On the other hand, the FHFA Index recorded a 12th straight increase but at a slightly more modest pace of 0.6% MoM in August, decelerating from July’s 0.8%. Year-to-date, this index shows a 6% climb, with prices towering 4.7% above their previous mid-2022 high.

Now, you might wonder, why the discrepancy between these indices? Both track transaction pairs for accuracy in appreciating home prices, but the FHFA’s focus is narrower, only considering homes purchased with conforming mortgages—leaving out all-cash and jumbo loan-financed transactions.

Shifting gears to the labor market and monetary policy, job creation is still in the picture, but it's like the economy has taken its foot off the gas. ADP reported a gain of 113,000 jobs in September, a pace that’s noticeably off the >200,000 average earlier this year. Wage growth is also seeing a slowdown; job stayers saw a 5.7% increase YoY, and job leavers enjoyed an 8.4% bump—both quite a step down from last year's figures.

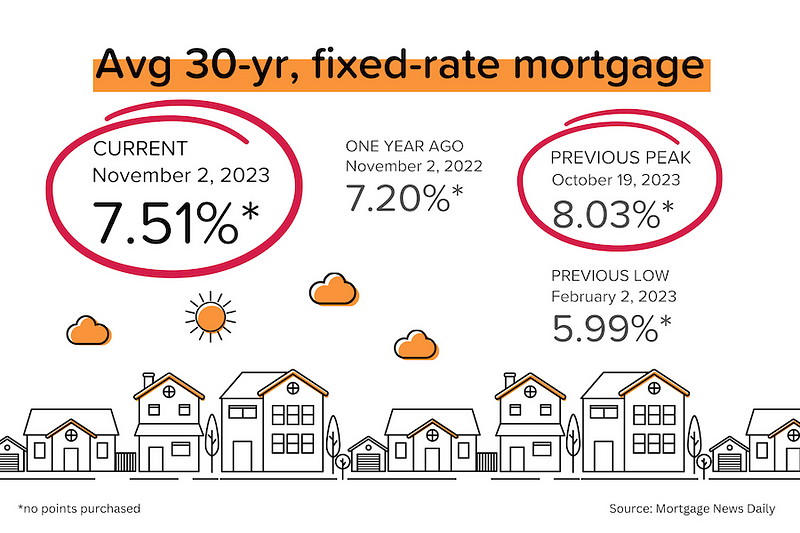

The Federal Reserve maintained its policy rate at 525–550 basis points (5.25–5.50%) this round, marking a pause that some may find surprisingly dovish, especially amidst Chairman Powell's firm stance. The bond market responded favorably, with yields dipping as 30-year mortgage rates fell to 7.51%—a collective sigh from the market perhaps, buoyed by weaker job growth and manufacturing data, along with a dash of reassurance from Powell's remarks.

📈 Big City Index Breakdown 🌆:

🎉 All-Time Highs: 10 of 20 cities setting records! 🚀 Chicago & New York strut 5% above their mid-2022 peaks, while Cleveland rocks a 4% increase.

🏖️ Sunny Gains: San Diego soars 7.5% YTD, with NYC not far behind at +6.1% YTD. Zero big cities dipping this year. Zero!

🌅 On the Cusp: LA, San Diego, & Tampa Bay are on the brink of new peaks. Stay tuned! 📈

🌉 Rebounds & Recoveries: San Francisco, Seattle, Las Vegas, & Phoenix are still playing catch-up but watch Seattle & Vegas bounce back quick!

🔄 History Repeats...Or Does It?: Aggressive Fed hikes usually don't stick around. As rates plateau, we're eyeing a potential ‘soft landing’ from this wild ride.

🏦 Fed's Whispering ‘Stop’?: With back-to-back rate holds, the market’s reading between the lines. Could this be a subtle full stop?

💸 Mortgage Rate Relief: Big cheers as rates drop over half a percent in days! 🥳 From nearly 8% to a cooler 7.5%, we’re moving in the right direction.

🗓️ Countdown to Dec 13 FOMC: Market bets are in, with a whopping 85% leaning towards another pause from the Fed. Will they hold steady? Time will tell! 🎲📉

Recent Posts

GET MORE INFORMATION