What's Up Real Estate - October

🛒 Retail Frenzy & The Fed's Headache

People are spending like there's no tomorrow. September retail sales jumped 0.7% MoM, flying past the 0.3% expectation. This stokes fears of 'higher for longer' interest rates. Meanwhile, the 10-year U.S. Treasury yield closed at a jaw-dropping 4.97%, a high we haven't seen since 2007.

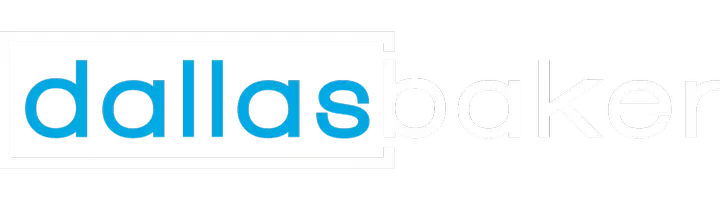

🏠 The Big Chill in Home Sales

Hold onto your hats. Home sales are at an all-time low, and the number of new mortgage applications has dropped to levels not seen since 1995. What's going on? Between skyrocketing rates and economic uncertainty, buyers are playing it safe. Even adjustable-rate mortgages are making a comeback as people scramble for better rates.

📆 Why Now Might Be the Best Worst Time to Move

It's that time of the year when inventory goes up, and prices take a dip. It's the seasonality of the market: not many want to move in the middle of winter. However, some sellers, eager to unload, could offer you a pretty sweet deal.

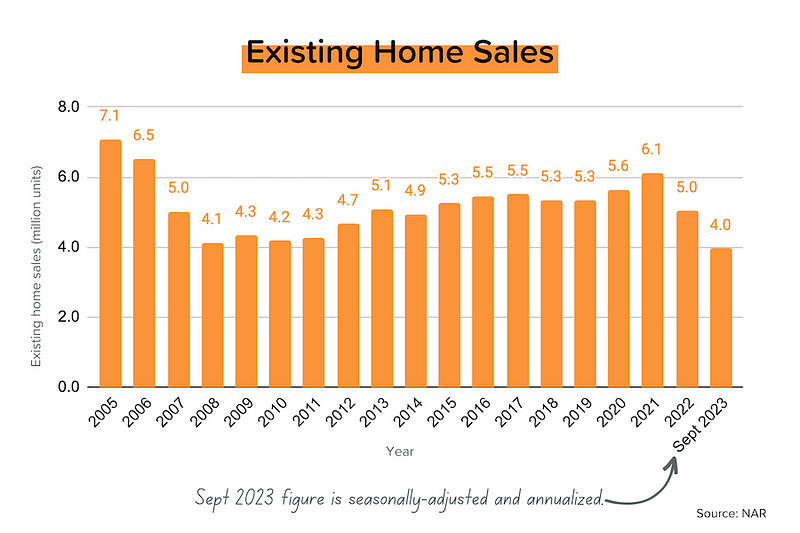

🎢 Mortgage Rates: Buckle Up!

Remember the 7.08% dip in August? Good times. Now, 30-year mortgage rates are over 8%, and the Fed is showing no signs of slowing down. The future isn't looking too rosy either, with a 37% chance of another rate hike in December.

🔮 What's Different This Time?

Here's a kicker: The last time the 10-year U.S. Treasury yield was this high, mortgage rates were 1% lower. Blame it on the uncertainty around the Fed’s moves and an inverted yield curve that no one can make heads or tails of.

📚 References

-

New Mortgages: CNBC Report

-

Treasuries Yields: Reuters

-

Retail Sales: Census Gov

-

Mortgage Rates: CNBC Report

Recent Posts

GET MORE INFORMATION