What's Up Real Estate - September

Guess what, folks? The Federal Reserve decided to kick back and do...well, nothing. Rates are staying the same for now. But don't be fooled—this 'do-nothing' move has everyone talking!

📈 The Good News:

The Fed sees stronger economic growth on the horizon. That means businesses booming and more money in your pocket.

🎢 The Plot Twist:

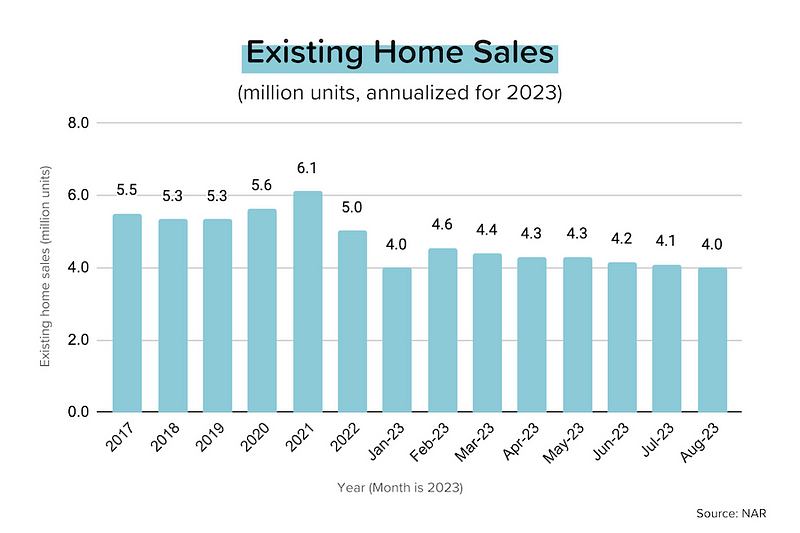

While the Fed lounges, mortgage rates are inching back to recent highs. House hunting getting a bit too hot for your liking? You're not alone—fewer people are sealing deals on homes. [industry intel - NAR]

💰 What's Up with Home Prices?

Despite fewer transactions, home prices aren't getting the memo—they're still on the up and up. [Zillow HVI] [ZHVI Fred]

🔨 Builder Blues: Confidence Takes a Dive 📉

Hold on to your hard hats! Builder confidence just slid for the second month in a row. According to the National Association of Homebuilders, their Housing Market Index dipped below 50. That's bearish territory, folks, and it's the first time we've seen this since December 2022. [Builder Confidence Data]

💸 HVI's Crystal Ball: $20K in Home Appreciation! 🏡

The property portal's got some news for you. They're predicting a 4.9% boost in their Home Value Index (HVI) over the next year. Got a $400K house? That's almost a $20K increase in value! Sure, home prices and mortgage rates are soaring, but so is the "cost of waiting" when home prices are this hot. [BiggerPockets]

📉 LEI's Long Slump: 17-Month Losing Streak 📊

Heads up, economic junkies. The Conference Board's Leading Economic Indicators (LEI) Index fell 0.4% in August. We're talking 17 months of decline here. If we dodge a recession after all this, we might just quit paying attention to the LEI altogether. [The Conference Board]

🤔 Why Haven't You Bought Yet? Here's What People Say: 🗣️

- Budget Woes - 34% can't find homes in their price range.

- Rate Watchers - 18% are waiting for those mortgage rates to dip.

- Price Drop Hopefuls - 9% think home prices will drop.

- Current Home Jitters - 7% worry about selling their existing home.

- Bid War Blues - 5% don't want to duke it out with multiple offers.

- Credit Crunched - 4% are stumbling on loan approval due to credit.

- Down Payment Dilemma - 3% just can't save up enough.

Let's face it, 1/4 of you are waiting for that magic combo: lower home prices and mortgage rates. But here's the kicker: home prices are mainly going up. Time's ticking! ⏰

💰 Down Payment Roadblocks: What's Holding You Back? 🚧

- No Issue - 47% say they're good to go.

- Rent or Mortgage - 23% say current housing costs are the obstacle.

- Credit Card Debt - 17% point to their plastic.

- Student Loans - 12% blame education debt.

- Car Loan - 11% are strapped by their wheels.

Almost 30% of you are held back by credit card or car loan debt. If you're in this club, chat with a lender about debt consolidation. Even at a 7.5% mortgage rate, you could save big on interest. [NAR Barriers of Home Buyers Survey]

👀 Confidence Dips but Competition Doesn't Chill 🥊

- Future Traffic: Only 11% of Realtors expect more buyers soon, and a mere 10% see more sellers entering the fray.

But don't let that fool you! Homes are still flying off the shelves like hotcakes, and the competition is, well, let's call it "fierce."

🏡 August 2023 Real Estate Fast Facts 📊

- Speedy Sales: Homes spent just 20 days on the market, on average.

- Quick Turnover: 72% of homes sold were listed for less than a month (down slightly from 74% in July).

- First-Timers: They made up 29% of sales (steady as she goes!).

- Cash is King: 27% of sales were all-cash deals (also holding steady).

- Above Asking: 31% of homes sold for more than the list price.

- Bidding Wars: Each home sold had an average of 3.2 offers.

- [NAR Confidence Index]

My Notes

📰 Press Release Rewind: The Fed's Adjective Shuffle 🎶

Read closely and you might notice: not much has changed since the Fed's last pow-wow. But let's break down some subtle wordplay:

- Economy: We went from "moderate" to "solid." So we're getting steadier, folks!

- Jobs: "Robust" is out, and "strong" is in.

- Rate Hikes: Eyes are still glued to the data.

- Inflation: Yep, it's still a concern. 2% target remains.

- Rate Forecast for 2023: Steady at 5.6%, implying a +25 basis point hike before year-end.

- Rate Forecast for 2024: Now at 5.1%, down from 4.6%. Expect fewer cuts, arriving later.

📈 What Does It All Mean? 🤔

The Fed's not rushing to slash rates. Good news: the economy and job market are holding up. Not-so-good news: homebuyers and us real estate folks might not see relief in mortgage rates anytime soon. [Fed Press Conference]

📅 That Wraps Up September! Up Next: Buyer's Season 🏠

To all my prospective buyers: the next few months are your time to shine. With folks stepping back for holiday festivities, you'll face less competition. Translation? Stronger negotiating power on price and interest rate credits.

📊 Worried About Rates? I've Got You Covered 👌

My real estate assistant doubles as a loan officer, and we can help you snag up to a 3% buy-down on your loan.

Thanks again for being awesome readers, and until next time!

Recent Posts